REBALANCE YOUR PORTFOLIO USING PRECIOUS METALS

Is your portfolio prepared for today’s investing environment? Let us help you understand a bit more about the importance of a balanced investment portfolio by adding precious metals.

Precious metals are commodities; they can be added to your portfolio as a way to fight market cyclical recessions and also be used at times of financial uncertainty. There are many aspects to take into consideration; for example, precious metal investments don’t work in the same ways as other securities such as bonds and stocks, but they can be very useful as a way to rebalance your portfolio.

Three ways in which you can invest in precious metals, and it is generally recommended that you build up your portfolio to include all three of them.

- Sell and Buy

- Physical exchange of metals

- Invest in mining stocks

selling and buying. Use the price fluctuations to your advantage to trade bullion, sell when the time is right, and invest in other forms of trading. The same goes for buying when the timing is right and prices are low to make the most of your investments. Keep in mind the transaction fees associated with trading.

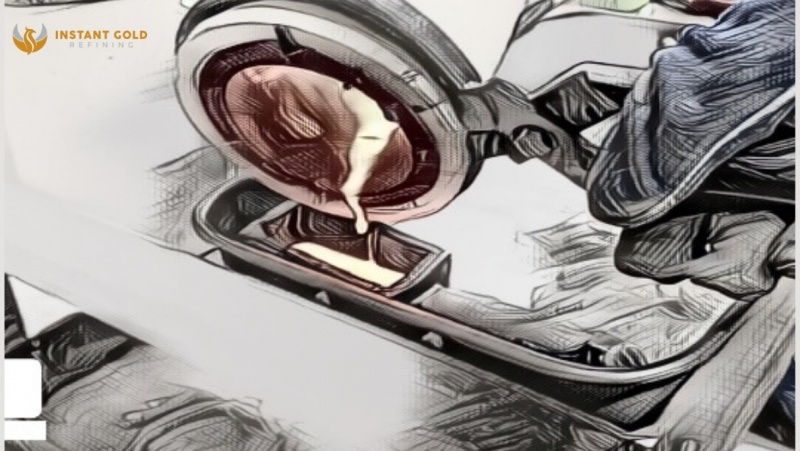

Another way is through the physical exchange of metals. This one is obvious enough: you can always exchange your metals for other types of metals. If your metal stock is unbalanced with an excess of gold, silver, platinum, or palladium, you can use the extra metals and exchange them for a different type of bullion. Depending on your preferred type of trade (online, in person, with a broker, exchange with a friend, ets) there must also be costs associated with this type of exchange such as shipping, storage costs, etc.

ETFs (mining stocks) come with counterparty risks and management fees. You don’t actually own physical precious metals yourself, but rather a fund that invests in the metal. When it comes to stocks, they do not follow the same pricing as physical metals. There are many other factors associated with mining stock prices, such as the costs of actually finding and extracting the metals. These costs are always on the rise due to the increasing depth of the metals and finding new deposits over time.